The previous blogs cover battery costs and battery storage costing less. This is about BEVs (battery electric vehicles) coming down in cost because the cost of the batteries is the most expensive part of the BEV and by 2023 the costs of batteries is predicted to be $100 per kWh. For a BEV with 75 kWh that’s about $7500.00. Now at the end of 2020 it’s about $160 per kWh or about $12000.00.

From 19:45 at https://youtu.be/O-kbzfWzvSI

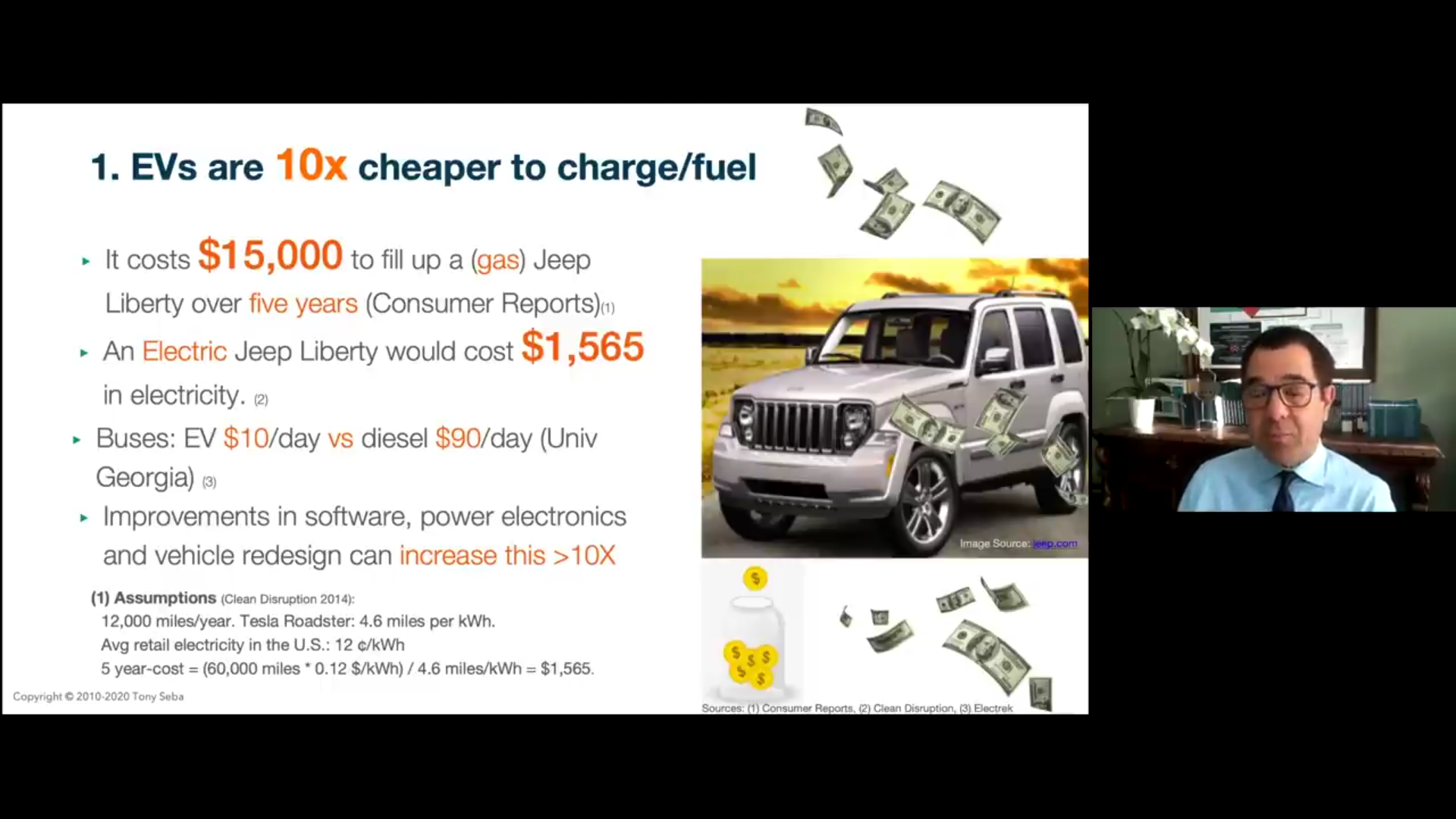

He says EVs have 100 times fewer parts and are 10 times cheaper to maintain (Baron Funds). I would say that 100x should be more like 30x. He says that Tesla gives “infinite mile warranty”(source: Tesla blog). I would like to see that claim from a more authoritative source.

He shows a chart of the downward curve of the cost of battery electric vehicles and says (Quote)

“By 2025 the market will offer unsubsidized EVs with 200 mile range for $12,500.00.”

Actually there are EVs in China that are about that price range. They may not be allowed to import them to the US because they don’t meet crash safety tests.

He also says that “by 2025, every new car will be electric – for purely economic reasons.” Europe and California have a law that says every new car sold must be electric by 2035. I can see where that timeline may be sooner, but I’m not sure that it will happen by 2025. I hope it happens because we must stop using fossil fuels as quickly as possible in order to avoid catastrophic climate change. I heard Elon Musk say that they will get the cost of batteries down to under $100 per kWh, which will allow Tesla to offer EVs for $25,000.00. This should happen once the Gigafactories in Berlin, Germany and Austin, Texas are operational. The GF Texas will have a battery manufacturing facility – Tesla applied for permits for making batteries. The limit that is holding back Tesla and all BEV makers is the ability to supply enough batteries to meet the demands of EVs, and all the billions of other things in our lives that depend on Lithium batteries, such as cellphones.

He also says that the resale value of ICE (gasoline engine) cars will go down. With all the car loans, and the ICE vehicles worth much less, the payments of car loans will go up as they finance companies try to recover from the losses. I don’t know that much about financing but it looks like there will be disruption in the finance industry. I know that after a loan is made, the loan company can sell the loan to a big bank so they can get more money to loan. If the big banks get into the same horrible mess they got into in 2008-2009 then the big banks might become insolvent and come begging to government to save them again.

He goes on to say that by 2025, all cars will be new EVs. And the whole market for the ICE (internal combustion engine) will be wiped out by 2030. The ICE car companies will not be competitive when BEVs are much cheaper to buy, to maintain and to ‘fill up’ with a charge than the ICE vehicles. It’s obvious that there is no point in buying a used car when the customer can buy a new electric vehicle for $12,500.00 and it’s cheaper to maintain and costs 1/5th the $$ to charge.

He shows a slide:

THE VERGE Sept 19, 2019

Amazon orders 100,000 Electric Vans from Rivian

“Amazon CEO Jeff Bezos said the company placed an order for 100,000 electric delivery vans from Michigan-based startup Rivian. He expects… first vans to hit road by 2021 [and] all 100,000 vans to be on the road by 2024.”

Rivian CEO: vans will travel 400 miles on a single charge, hit 60 mph (100 Km/h] in < 3 seconds and eventually drive themselves.

Biz Model Innovation: Delivery Services Partners. Franchising the delivery business…

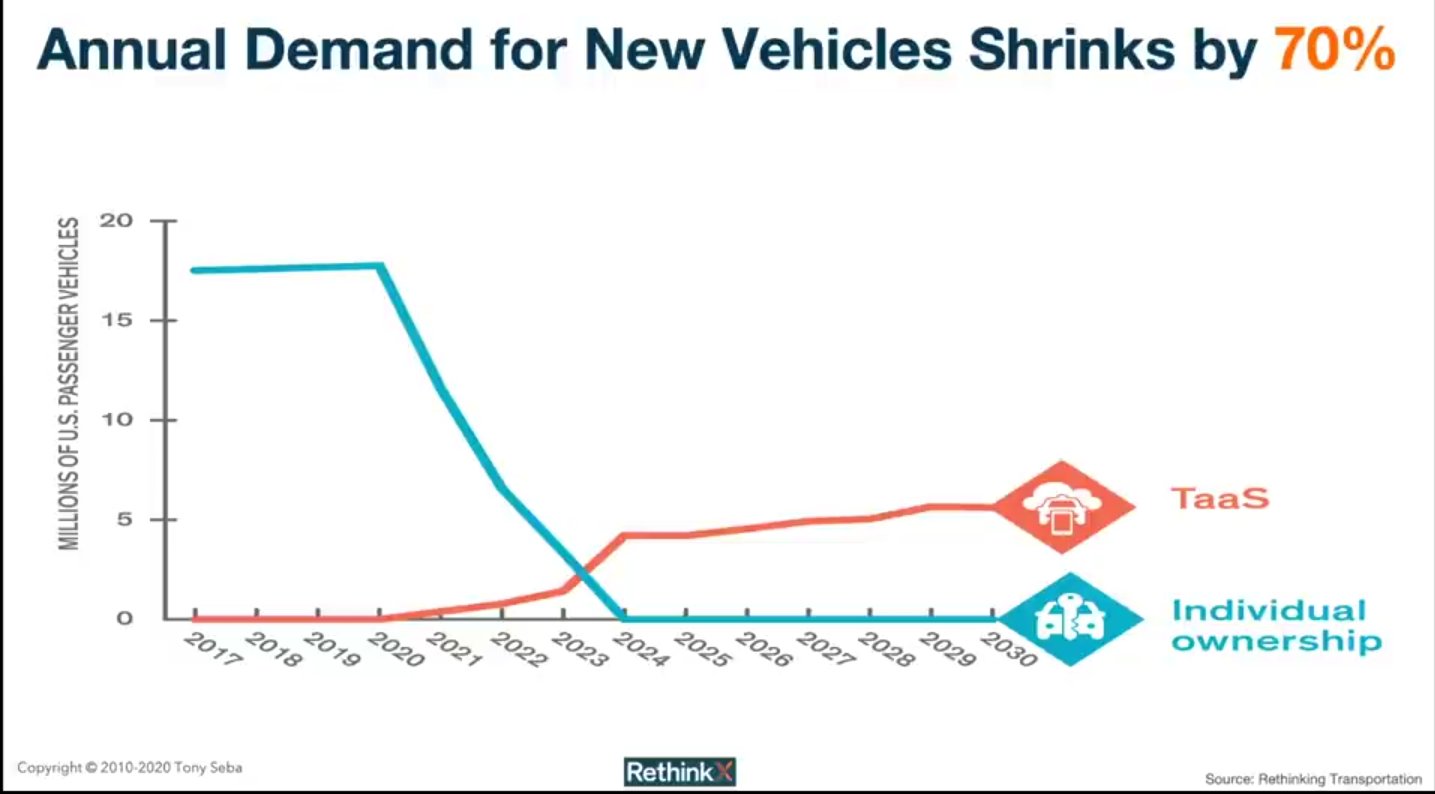

The # of US Vehicles Shrink 70%

He predicts that by 2024 the number of vehicles in the US will shrink by 70 percent. This is due to the number of commuters who will switch from IO (individual owner) to TaaS (Transportation as a Service). The cars sit unused for 95% of the time, so autonomous robo-taxis will change the vehicles to fleets of driverless vehicles with the vehicles being used much more of the time.

I see several potential conflicts with the future situation. The prices of BEVs will drop to $12,500.00 by 2025. But if individual ownership drops to nearly zero as shown, then the average commuter will have no incentive to buy a BEV so the low prices will not be attractive to consumers. They will only be interested in how much their monthly bill is for TaaS. The other aspect is that the lack of vehicle sales will counteract the downward pressure on the prices of BEVs. The prices will find a point where the EV prices will stabilize and the vehicle makers will have to consolidate in order to survive with such low volume of new vehicle sales.

There will be external effects to other businesses. The number of cars parked will be much lower, so fewer parking lots or structures will be needed. There will be a lot fewer vehicles on the roads, so much less crowded highways. The businesses such as car washes, auto supplies, collision repair shops, auto insurance companies, etc. will all have much less business. The drive-thru restaurants will have less business. The biggest reduction in business will be the gas stations – they will be replaced by EV charging stations. The hardware stores may end up selling containers of gasoline for lawnmowers, chainsaws, etc.